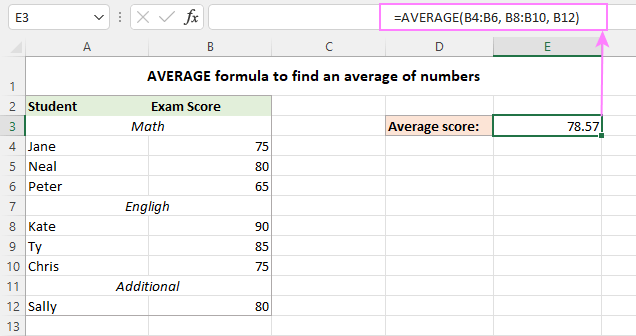

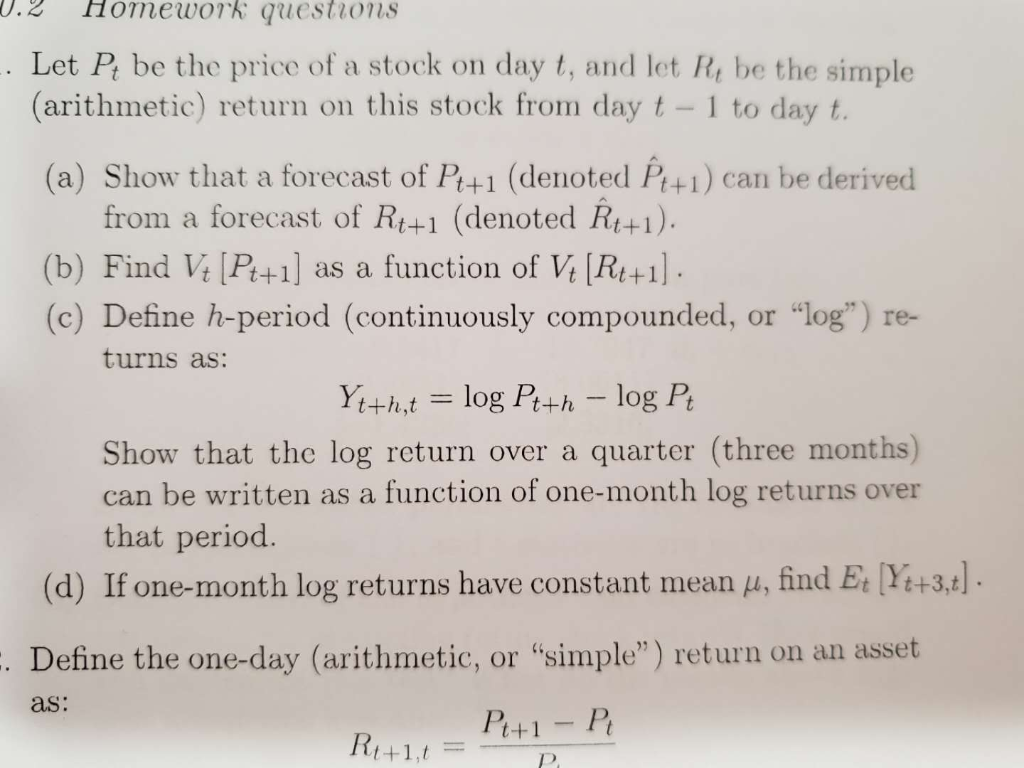

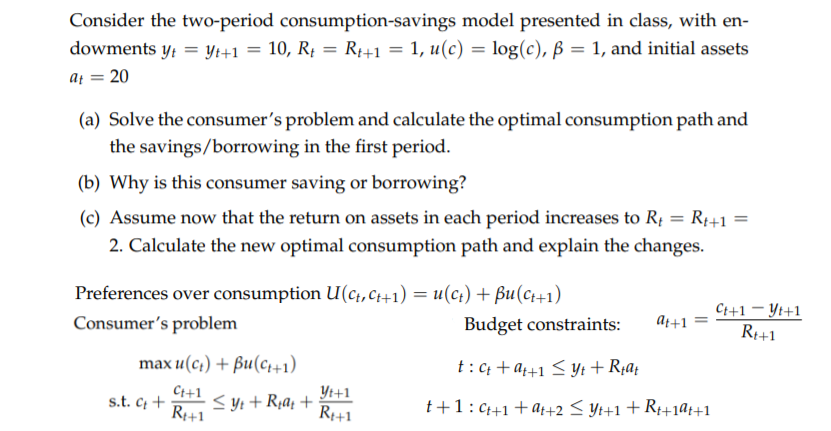

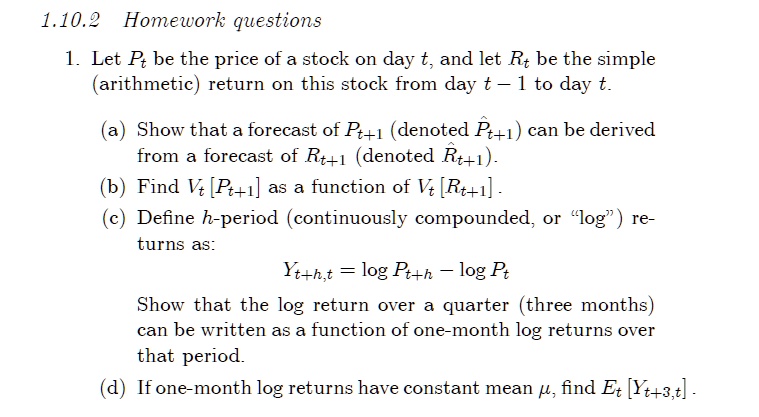

SOLVED: 1.10.2 Homework questions Let Pt be the price of a stock on day t, and let Rt be the simple (arithmetic) return on this stock from day t = 1 to

The figure plots the time series of daily log returns, log realized... | Download Scientific Diagram

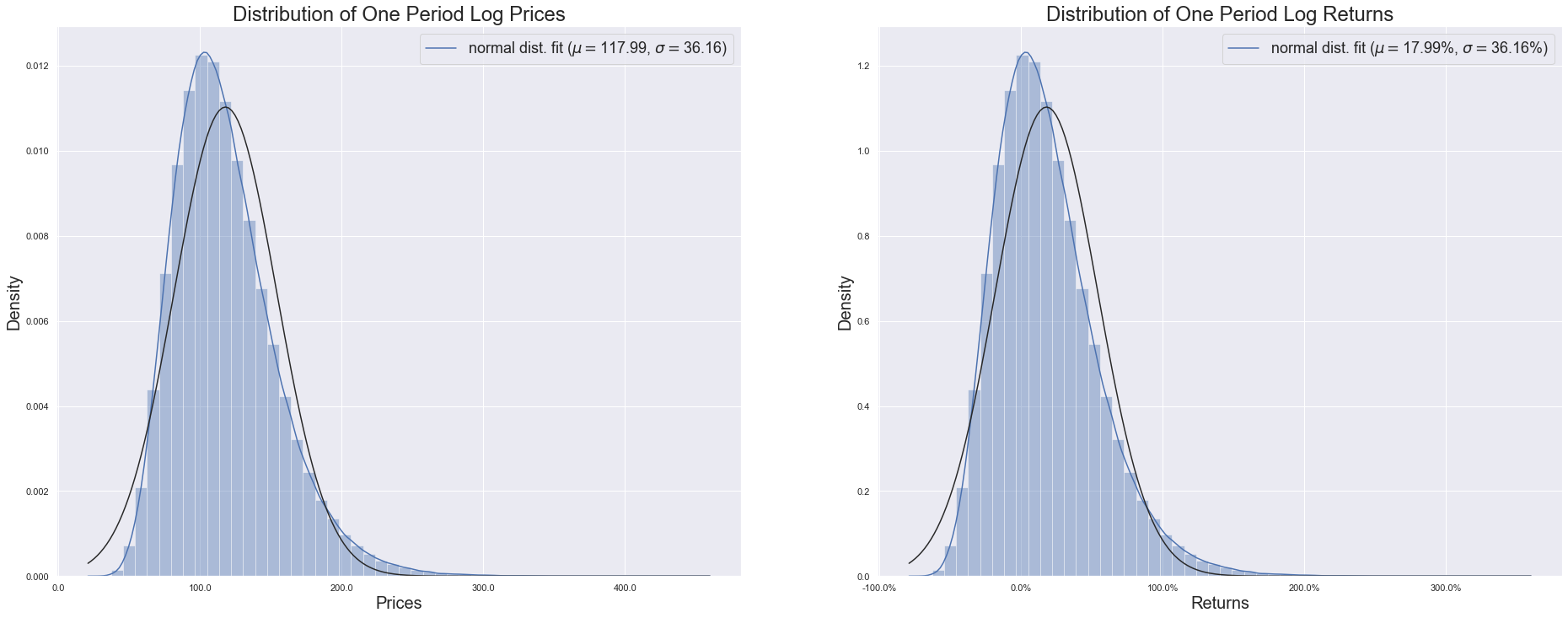

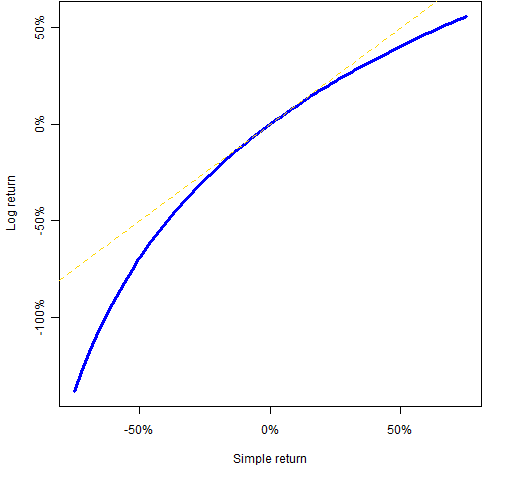

Risk-adjusted performance measurement: Log returns vs. simple returns and geometric vs. arithmetic mean return - Quantitative Finance Stack Exchange

A tale of two returns | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

SOLVED: Suppose log return r ∼ N(0, 0.12 ). (a) Find E(R) and Var(R). (b) Find Pr(R < −0.1). (c) What is the probability that a simple two-period return is less than

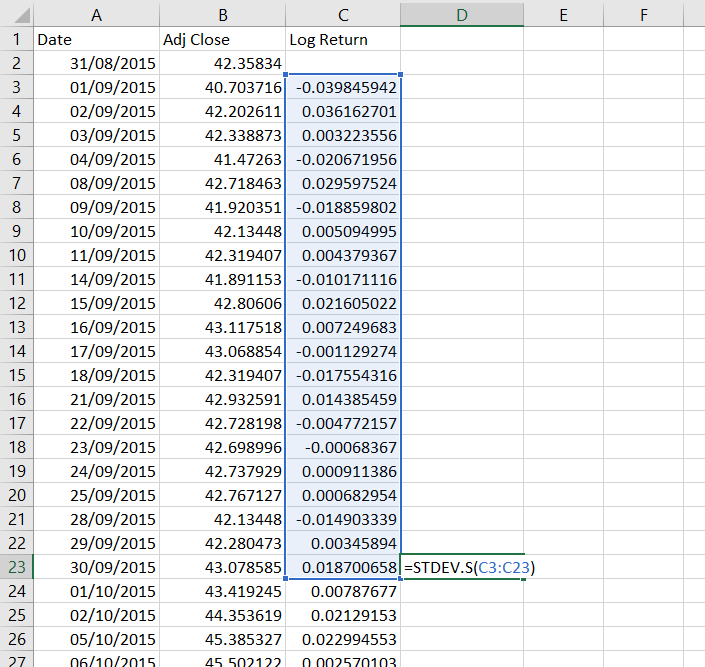

How to calculate Log return , daily return and Holding period return for stock market data - YouTube